Documentary evidence of sending and receiving

Electronic notification

Pay per use. No registration fees. No expiration date.

As simple as sending an email.

Sign documents and contracts

Our locations We are global

Lleida

Madrid

Paris

London

Miami

Dubai

San José

Bogotá

São Paulo

Tokyo

Santo Domingo

Cape Town

Johannesburg

Montevideo

Santiago de Chile

Lima

Beirut

Ciudad de México

Our customers trust us

Case studies

We particularly loved the ease and agility of contracting the system and its credit-based use. In other words, you top up some credits and start working without too much training, without any specific software installation or technical complexity

Registered notification service has made possible to help in the internal operating processes of companies and in their digital transformation.

Lleida.net gives us peace of mind and guarantees that parents verify the engagement of our services in a simple safely and legally way.

Connectaclik Pro has provided Holaluz with effective and customized solutions,a must have for any services we will add to our processes.

“Thanks to this agreement we would provide security, reliability and efficiency to our users. Being a technological platform it is crucial to offer the highest quality and the greatest attention to our customers”

News, interviews, tutorials

Blog

13 January, 2026

13 January, 2026

Legal validity of PDF signatures: how to secure it with qualified time stamping

Electronic signatures have become standard in business documentation. Contracts, invoices, consents, and corporate agreements are routinely signed as PDFs using tools such as Adobe Acrobat and similar readers. The process is fast, familiar, and widely accepted.

What is less visible is the legal strength of those signatures over time.

A document may look correctly signed today, but what happens if it is challenged months or years later? Can the signing date be proven beyond doubt? Can the document’s integrity be demonstrated to a judge, an auditor, or a forensic expert?

These questions are not theoretical. They sit at the heart of legal certainty in digital documentation, and they are precisely where time stamping plays a decisive role.

What makes a PDF signature legally robust?

Most PDF signing tools rely on digital certificates to identify the signer and bind their identity to the document. This provides a solid foundation, but it does not automatically guarantee long-term legal validity.

For an electronic signature to stand up legally, three elements must be demonstrable:

- Who signed the document

- What content was signed, without alteration

- When the signature was applied, with certainty and proof

The first two elements are usually covered by the certificate and the cryptographic seal. The third reliable proof of the exact signing time is where weaknesses often appear.

Without a qualified electronic time stamp, the signing date may rely on local system data or internal metadata that cannot be independently verified.

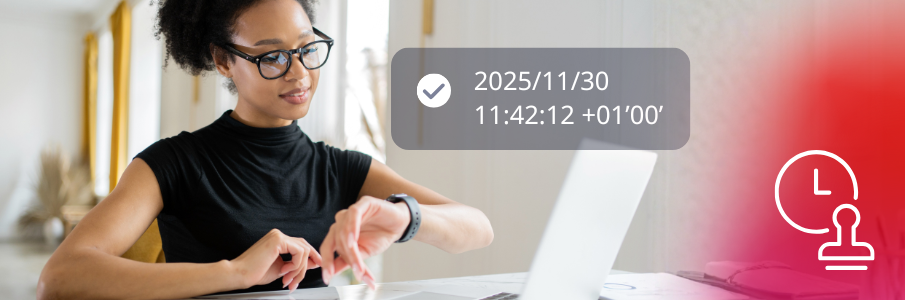

What is electronic time stamping?

Electronic time stamping is a trust service that certifies the exact date and time at which a digital document existed in a specific state.

The time stamp is issued by a Qualified Trust Service Provider (QTSP) acting as an independent third party. Once applied, it creates verifiable evidence that:

- the document existed at that precise moment

- its content has not been modified since

- the time reference comes from a trusted, certified source

This is not a technical detail. It is a legal safeguard.

Time stamping is widely used to support electronic signatures, certify digital transactions, seal audit logs, validate electronic invoices, and preserve evidence that must remain reliable over time.

The risks of signing PDFs without a qualified time stamp

Weak evidential value

Without a qualified time stamp, there is no independent proof of the exact signing moment. In legal proceedings or audits, this gap can be questioned.

Example: a contract marked as signed on “3 May” may be disputed if one party argues it was signed after a deadline.

Possibility of repudiation

A signer may deny having signed the document at a specific time. System clocks, time zones, or device configurations can be altered without leaving reliable evidence.

Reduced legal weight

Under the eIDAS Regulation, time stamping strengthens electronic signatures by anchoring them to a certified time. Without it, the signature may be treated as a simple electronic signature with lower probative value.

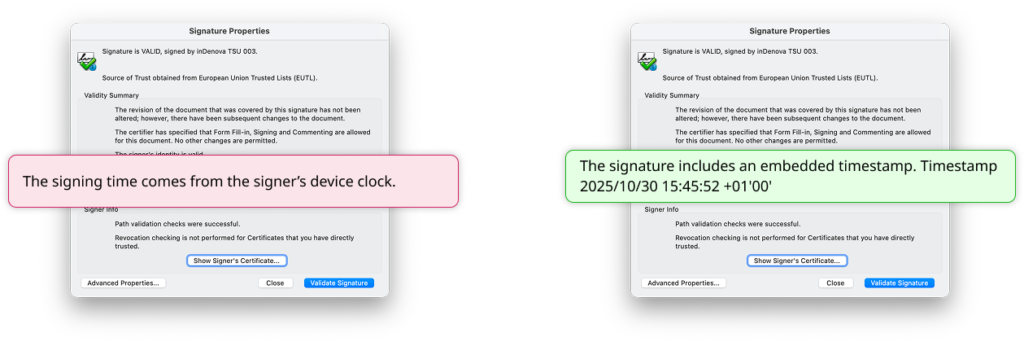

A common scenario: signing PDFs in Adobe Acrobat

Signing a document in Adobe Acrobat with a digital certificate is a widespread practice. However, if no qualified time stamp is applied, the date and time associated with the signature are taken from the user’s device.

That timestamp is not issued, verified, or guaranteed by a trusted third party.

From a compliance perspective, this creates an evidential weakness that may only surface when the document is reviewed under scrutiny.

“From a compliance standpoint, signing PDFs without a qualified time stamp leaves room for evidential challenges in audits or legal disputes. Time stamping is essential to preserve legal validity over time.”

Compliance Department, Lleida.net

How to secure the legal validity of PDF signatures

Strengthening the legal value of a PDF signature does not require changing tools or workflows.

Qualified time stamping can be added to existing signing processes, including signatures created in Adobe and other PDF readers. Often, time stamping can be configured directly at the user level without technical development.

For organisations handling high volumes of documents or automated processes, time-stamping services are also available via API, allowing seamless integration into digital workflows.

The result is simple: the same signing experience, with significantly stronger legal certainty.

Time stamping that is self-managed, simple, and scalable

Easy user-level configuration

Most PDF readers allow time stamping to be configured directly at user level, without technical development or changes to existing workflows. Users only need the credentials provided by the qualified trust service provider, typically delivered securely by email.

This approach allows organisations to reinforce legal validity without disrupting daily operations.

HTTP protocol implementation for automated environments

For high-volume use cases or automated environments, qualified time stamping is also available via HTTP integration.

This enables organisations to integrate time stamping directly into back-office systems, document management platforms, or automated signing workflows.

Legal recognition under eIDAS and beyond

Qualified electronic time stamps are explicitly recognised under the eIDAS Regulation (EU No 910/2014).

A qualified time stamp benefits from a reinforced legal presumption:

- The indicated date and time are presumed accurate

- The integrity of the data is presumed

- The evidence is legally recognised across the European Union

Similar principles apply in multiple jurisdictions across Latin America and other regulated markets, making time stamping a key element for cross-border digital documentation.

International recognition

The legal validity of electronic signatures and time stamping is also recognised in multiple jurisdictions:

- Colombia: Law 527 of 1999 regulates the chronological stamping of data messages.

- Peru: Supreme Decree 052-2008 (Art. 33) establishes temporal certification for electronic documents.

- Dominican Republic: Decree 335-2004 develops Law 126-02 on electronic signatures.

- United Arab Emirates: Federal Law 46 of 2021 recognises integrity and authenticity requirements for digital documents.

As an authorised provider in these countries, Lleida.net offers services within the scope of ISO 27001 and ENS, and recognised by official bodies such as ONAC in Colombia and Indecopi in Peru as a value-added service.

Why time stamping matters in the long term

Digital certificates expire. Cryptographic standards evolve. Systems are replaced.

Documents, however, often need to remain valid for years: contracts, invoices, corporate records, regulatory evidence. Without a trusted temporal anchor, their legal value may erode over time.

A qualified electronic time stamp fixes the document in time. It preserves its evidential value even if the signer’s certificate has expired or the signature is examined long after it was applied.

Do not leave legal certainty to chance.

Buy a time stamp and sign with long-term legal confidence.

27 November, 2025

27 November, 2025

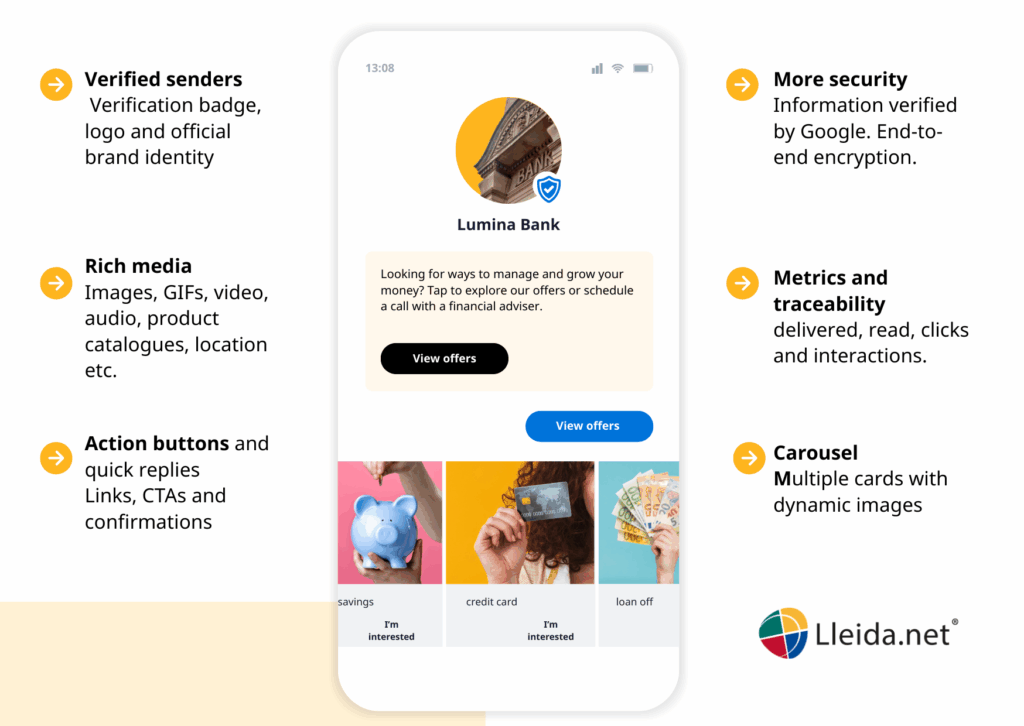

RCS for Business: The Messaging Standard Transforming Customer Interaction

RCS for Business is redefining how organisations capture customer attention in a landscape where SMS has reached its limits. Traditional text messages remain short, static and easy to impersonate, while RCS turns the messaging inbox into a verified, visual and interactive channel where communication feels clearer, safer and far more engaging.

From high-resolution video and branded carousels to one-tap actions and real-time updates, RCS brings the fluidity of an app to the native messaging environment.

What RCS Really Brings to Business Communication

Rich Communication Services (RCS), backed by the GSMA and supported by Google and major operators, pushes mobile messaging into the next decade.

Its goal is to overcome the limitations of SMS and MMS by offering an advanced, upgraded messaging experience.

In its business version, RCS allows companies to communicate through a verified channel, include relevant business information and benefit from traceable message delivery.

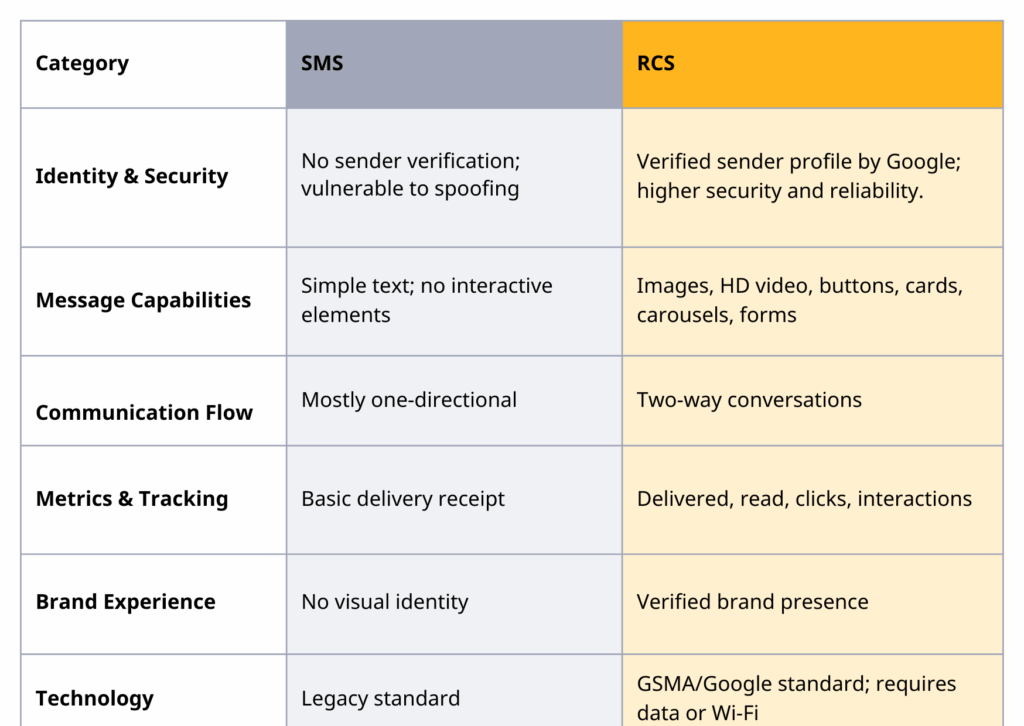

RCS vs SMS: What Makes the Difference

The contrast is easy to see. An SMS delivers a basic text message.

RCS enables richer content, clearer guidance and a recognisable brand presence , all within the user’s native messaging app.

This stronger, more trustworthy experience explains why around 74% of users say they are more willing to engage with companies through RCS.

RCS vs SMS: What Changes and Why It Matters

RCS supports typing indicators, read receipts, file sharing, HD photos and videos, group conversations, and even video calls

Everything appears directly within the phone’s messaging interface , no need to switch apps.

Advanced Features That Expand What RCS Can Do

Developed with operators and Google, RCS includes the security and reliability required for business communications. It also supports additional options such as geolocation.

For example, an airline can offer a complete digital check-in experience: boarding passes, terminal maps, counters and gate information , all in a single message.

RCS Compatibility Detection

Before sending, the system could check whether the number supports RCS. If not, the message is automatically delivered as SMS to ensure reach.

Global RCS Coverage

RCS is already established in countries such as the UK, Spain, France, Germany, Italy, Mexico, Brazil, Canada and India, allowing scalable international campaigns.

RCS Features That Increase Sales and Conversions

Imagine sending a credit card activation message. A standard SMS can feel basic or untrustworthy. With RCS, you can include account details, product images, interactive buttons and direct links to loyalty programmes.

You can also embed a product or service catalogue with personalised suggestions, all backed by a verified badge, brand logo and corporate identity.

In a single message, you improve customer experience, strengthen trust and create opportunities for cross-selling and up-selling.

Using RCS to Collect Consent and Automate Processes

RCS enables guided, secure flows for gathering user information, recording consent and automating steps that previously required calls, emails or web portals.

Buttons, built-in forms and structured responses simplify processes that previously required calls, emails or web portals , while preserving full traceability for audits.

Examples of Use

- Acceptance of terms and policies

“Accept / Decline” buttons with audited records. - User data updates

Integrated forms without redirecting to external sites. - Documented opt-in / opt-out

Visual confirmation aligned with data protection rules. - Quick surveys

One-tap ratings for fast feedback. - Interactive healthcare appointment reminders

Includes date, time, map and action buttons (Confirm / Reschedule / Contact).

RCS Business Costs: What You Need to Know

The price of RCS depends on factors such as message volume, the level of automation, the type of interactive template used and the needs of each communication flow.

Frequently Asked Questions

Yes. It offers verified senders, encryption and protection against fraud or spoofing.

Banking, retail, telecoms, healthcare, insurance, transport, e-commerce, utilities and any organisation that requires trusted communication.

It works on most modern Android devices and on iPhone with iOS 18 or later. If a device isn’t compatible, messages can be sent via SMS.

Many indicators suggest so. Google is positioning it as the new business messaging standard.

No. It is built into the device’s native messaging app.

13 October, 2025

13 October, 2025

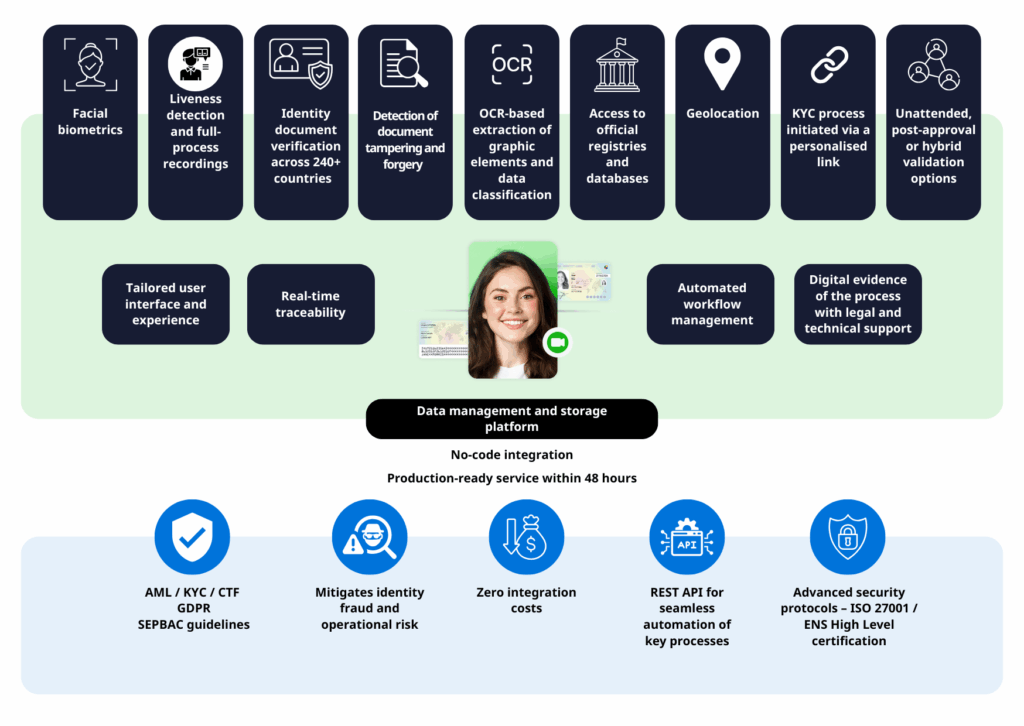

Identity verification: meeting KYC, AML6 and SEPBLAC standards

Verifying a customer’s identity — known as Know Your Customer or KYC — has become a crucial step for building trust between businesses and their users in today’s digital world.

More than just a formality when onboarding new clients, KYC is now one of the most effective tools for preventing digital fraud and reinforcing trust and security in online interactions.

Because of its growing importance, adopting this kind of technology is now essential for companies that need to comply with both national regulations (such as Spain’s SEPBLAC) and European directives (AML6 / KYC / CTF) designed to fight money laundering and the financing of terrorism.

Compliance and global regulations in identity verification

The way remote identity verification is regulated can vary widely from one country to another. However, every jurisdiction shares the same goal: ensuring that all digital transactions are transparent, secure and trustworthy.

Let’s have a look at the leading legal frameworks you should be aware of.

Supervision and regulations in Spain (SEPBLAC and AML compliance)

In Spain, the Law on the Prevention of Money Laundering and the Financing of Terrorism (Law 10/2010, 28 April) defines the obligations companies must meet to prevent criminal misuse of financial and business systems.

These obligations apply not only to banks and financial institutions, but also to a broad range of professionals and sectors , from real estate agencies and lawyers to auditors and jewellers.

The main goal of this legislation is to stop the financial system being used to launder money from illegal activities or to fund terrorism. It also establishes a strict penalty regime for organisations that fail to comply.

Main KYC and AML6 compliance measures include:

- Customer identification: verifying every client’s identity before a business relationship begins.

- Ongoing transaction monitoring: setting up internal systems to detect suspicious activity.

- Understanding the business purpose behind the relationship.

- Reporting suspicious operations: notifying SEPBLAC (Spain’s Financial Intelligence Unit) if a transaction may be linked to criminal activity.

- Document retention: keeping identification and transaction records for a minimum of 10 years.

SEPBLAC: Spain’s financial intelligence unit explained

SEPBLAC (Servicio Ejecutivo de la Comisión de Prevención del Blanqueo de Capitales e Infracciones Monetarias) is the Spanish authority responsible for preventing money laundering and terrorist financing.

It operates under the Ministry of Economic Affairs and Digital Transformation and includes representatives from the Bank of Spain, CNMV, National Police, Civil Guard, and Tax Agency.

Under its framework, SEPBLAC has approved the use of automated video identification, establishing technical and legal requirements to guarantee its validity and reliability.

SEPBLAC-approved digital identity verification and video identification

Digital identity verification systems authorised by SEPBLAC must comply with the following standards:

- Reliable identification through biometric and document validation.

- Full display of both sides of the ID.

- Real-time recording (live audio and video).

- Verification performed on a single device.

- Secure storage of electronic evidence.

- Advanced fraud detection and risk management.

- Data protection compliance under GDPR.

- Managed by qualified professionals.

eKYC Video is a secure, certified and SEPBLAC-compliant solution for digital identity verification.

Digital identity verification in the EU: AML6, CTF and GDPR compliance

Across Europe, the fight against money laundering and terrorism has evolved with the AML/CFT 2024 package, complemented by eIDAS and eIDAS 2 regulations.

Since 2016, the AML4, AML5 and AML6 directives have extended KYC and due diligence requirements to more sectors, strengthening the verification of beneficial ownership and enforcing tighter fraud prevention controls.

The new European Anti-Money Laundering Authority (AMLA) now coordinates these efforts, ensuring consistency across all EU states.

Technical standards and GDPR data protection

The ETSI EN 319 401 and ETSI EN 319 411-1 standards define the level of assurance required for trust service providers in identity verification.

Meanwhile, the General Data Protection Regulation (GDPR) safeguards the privacy and data rights of all EU citizens across digital identification processes.

→ Request a free eKYC Video demo and ensure compliance with AML6, SEPBLAC and GDPR today.

Staying compliant with eKYC Video

In this fast-moving regulatory landscape, eKYC Video is designed to grow alongside new laws — ensuring your company always meets the latest compliance and identity verification standards.

Why your business needs a compliant video identification system

Whether your business is in finance, real estate or technology, using a compliant video identification system like eKYC Video helps you:

- Identify customers accurately and securely.

- Prevent financial crime and digital fraud.

- Maintain trust and protect your brand reputation.

- Ensure seamless AML and KYC compliance.

- Improve efficiency in onboarding and verification workflows.

→ It’s time to integrate eKYC Video into your digital onboarding process.

eKYC Video: fast, secure digital identity verification

Lleida.net’s eKYC Video detects fraud in real time. As a no-code platform, it can be deployed in hours — providing a tailored, branded customer experience without complex integration.

Key features include:

Future-proofing your business with identity verification technology

As cyber threats grow more sophisticated, innovation in digital identity verification has become a strategic priority.

New technologies such as biometrics, blockchain-based decentralised identity, AI-powered machine learning, and passwordless authentication are shaping the next generation of secure, frictionless identity experiences.

At Lleida.net, we continue to push boundaries — combining compliance, technology and innovation to help businesses stay ahead of regulatory and security challenges.

FAQs on KYC, AML and eKYC Video

What is digital identity verification?

It’s a process that uses technology — including biometric recognition and document analysis — to confirm a person’s identity, helping to prevent fraud and unauthorised access.

What documents are accepted by eKYC Video?

You can use an official photo ID such as a passport, national identity card , residence permit or driving licence. eKYC Video supports over 240 international document types.

How does the video identification process work?

- Document capture: both sides of the ID are scanned for authenticity.

- Facial verification: the system matches a selfie with the ID photo using advanced algorithms and live checks like blinking or head movements.

- Automatic validation: once verified, the process is stored securely and made available on the management platform.

Why choose eKYC Video?

- Rapid deployment (under 48 hours)

- Full compliance (SEPBLAC, AML, GDPR)

- Customisable UX/UI

- Integration with other Lleida.net registered services

- No-code configuration